s corp estimated tax calculator

It can also be used to compute the penalty for underpayment of estimated tax M-2210. Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

S Corp Vs Llc Everything You Need To Know

Well even account for any estimated tax payments that you might.

. Thats why Ive created S Corp tax savings calculators for all 50 US. If the corporation has a valid Subchapter S election granted by the Internal Revenue Service and is doing business in South Carolina the S Corporation Income Tax Return must be filed. Find out why you should get connected with a CPA to file your taxes.

What is the salary you would pay yourself as S Corporation. C Corp Form 1120 Tax Return final due date if extension was filed. Federal Quarterly Estimated Tax4th installment.

Paying estimated taxes. Be informed and get ahead with. Payments due April 18 June 15 September 15 2022 and January 17 2023 Form IT-2658 is used by partnerships and S corporations to report and pay estimated tax on behalf of partners or shareholders who are nonresident individuals.

LLC S-Corp C-Corp - you name it well calculate it Services. For your reassurance that youve done it reporting compensation correctly you may wish to take a few minutes and look at the actual IRS instructions for Lines 12 and 13 on Form 1120 which can be viewed on Pages 11 and 12 of the official. Taxfyles small business tax calculator accurately estimates your business tax refundliability at the end of the year.

If an amendment changing your stock or par value was filed with the Division of Corporations during the year issued shares and total gross assets within 30 days of the amendment must be given for each portion of the year during which each distinct. The contribution to your SEP IRA must be made by the S corp and is deductible on the S corps tax return not your individual tax return. Since you are not self-employed you do not need to be using TurboTax Self Employed.

Description of Form IT-2658. The information generated by the Personal Retirement Calculator was developed by Chief Investment Office CIO to estimate how current savings or investments and estimated future contributions may help to meet estimated financial needs in retirement. Get your free estimate for self employment taxes including deductions.

The estimated tax payment is based on an estimation of your income for the current year. All estimated tax payments for corporate entities are to be made using Form SC1120-CDP or online using MyDORWAY. The maximum your S corp can contribute to your SEP IRA is 25 of your W-2 compensation.

Report of Estimated Tax for Nonresident Individual Partners and Shareholders. This is a tool to help calculate late file and late pay penalties and interest on a late filed Personal Income tax return. S Corporations are subject to an annual License Fee of 1 of capital and paid-in-surplus plus 15.

In addition every taxpayer having employees or a withholding tax liability or making retail sales in South Carolina must register by filing a. The S Corp Tax Calculator. That tax form again is included with the C-Corp tax package as part of the TurboTax Business product.

The Methodology Assumptions and Limitations of the Personal Retirement Calculator. Only use the calculator when you are sending your return and payment together. As long as you pay 100 percent of the previous years tax you wont be subject.

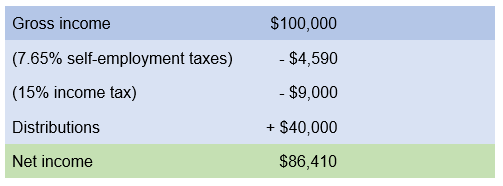

The S Corporation tax calculator below lets you choose how much to withdraw from your business each year and how much of it you will take as salary with the rest being taken as a distribution. Calculate Penalty and Interest. Claim your Research and Development Tax Credits on Form 941.

Get push notifications for tax due dates and estimated payments. To avoid this penalty use your previous years taxes as a guide. TurboTax Premier is sufficient.

As such it is possible to underestimate resulting in an underpayment and penalty. The License Fee cannot be less than 25. The minimum tax for the Assumed Par Value Capital Method of calculation is 40000.

Delaware Quarterly Estimated Franchise Tax Pay 20 of estimated annual amount if annual amount expected to exceed 5000.

Strategies For Minimizing Estimated Tax Payments

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Llc Tax Calculator Definitive Small Business Tax Estimator

Corporate Tax Meaning Calculation Examples Planning

The Basics Of S Corporation Stock Basis

S Corp Payroll Taxes Requirements How To Calculate More

Corporate Tax Meaning Calculation Examples Planning

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

How Much Does A Small Business Pay In Taxes

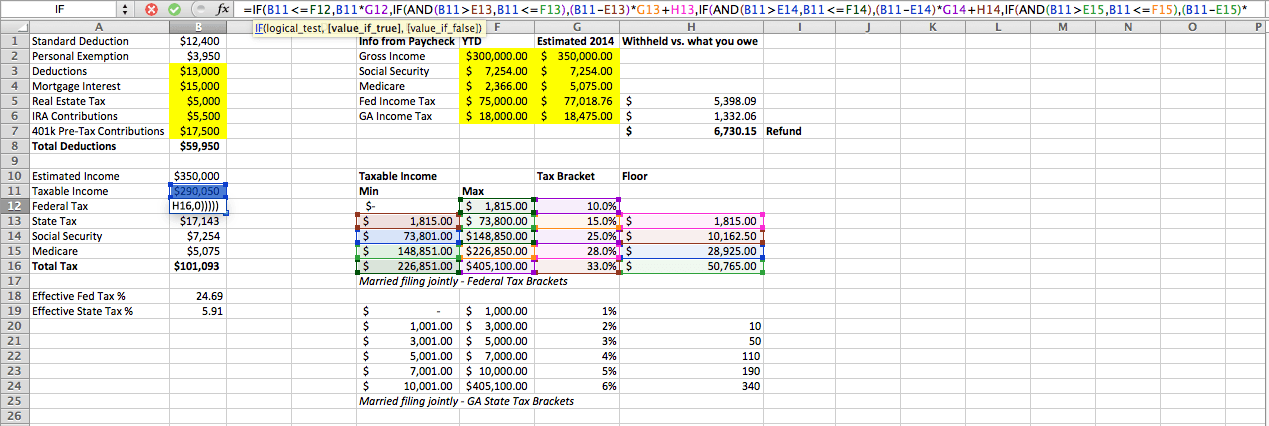

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Taxable Income Formula Examples How To Calculate Taxable Income

S Corp Tax Calculator Tax Consulting Tax Preparation Services Savings Calculator

S Corp Income Tax Rate What Is The S Corp Tax Rate

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Llc Tax Calculator Definitive Small Business Tax Estimator

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download