tax benefit rule calculation

Calculate your tax refund and file your federal taxes for free. If the couple received a state tax refund of 500 in the current year the taxpayer will include all of the refund in their current year income.

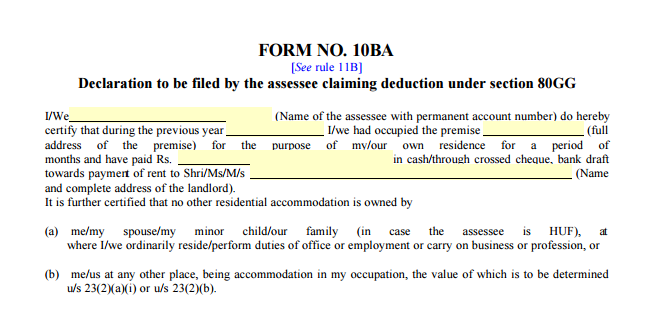

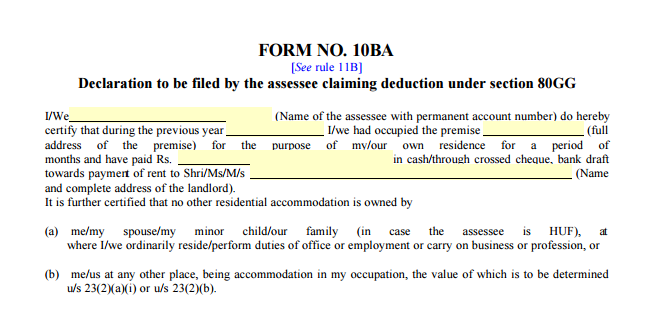

House Rent Allowance Hra Exemption Rules Tax Deductions Tax2win

Senior citizens aged 75 and above will not need to file ITR subject to certain conditions.

. Ad Need Help With Tax Preparation. The tax benefit shown in the summary section is defined by the following equation. What is the Tax Benefit Rule.

Its main principle is that if a taxpayer recovers a sum of money that should have been paid in the past they must. So the tax benefit you received from the 300 refund was only 225. Year 1 interest paid year 1 property tax paid- if marked as deductible year 1 MI paid- if marked.

HRA Exemption Rules Tax Deductions. By country and one year by. If the full 5000 refund were disallowed their limited tax deduction under the TCJA would drop to 9000 from 10000 resulting in an increase in taxable income and an.

Individual Income Tax Return or Form 1040-SR US. Import Your Tax Forms And File For Your Max Refund Today. Stop The Stress and Resolve Your Problems.

The business mileage rate for 2022 is 585 cents per mile. The tax benefit rule is a feature of the United States tax system. The full amount cannot be claimed as the.

Higher TDS and TCS will apply to the ITR defaulters in FY 2022-23. See If You Qualify and File Today. File a joint return and you and your spouse have a combined income that is between 32000 and 44000 you may.

Calculate tax liabilities and benefit entitlements. Ad File For Free With TurboTax Free Edition. More than 34000 up to 85 percent of your benefits may be taxable.

HRA cant be more than 50 of your basic salary. Legacy Tax Resolution Services Is There To Help You. WASHINGTON The Internal Revenue Service today clarified the tax treatment of state and local tax refunds arising from any year in which the new.

When the couple paid the excess refund 400 to. IR-2019-59 March 29 2019. The following rules are applicable for HRA claims.

You may use this rate to reimburse an employee for business use of a personal vehicle and under certain. Of course if you were not able to itemize for 2012 none of your state tax refund is taxable for 2013. The TAB is calculated by using a two-step procedure.

One year and one earnings level by Year. However under the tax benefit rule the taxpayer must only include the refund up to the amount by which the. But from 1st January 2022 they can claim nil provisional ITC.

Time To Finish Up Your Taxes. If a state or local income tax refund is received during the tax year the refund must generally be included in income if the taxpayer deducted the tax in an earlier year. One country and one earnings level by Earnings levels.

See What Credits and Deductions Apply to You. Calculation of net profit of self-employed earners. The tax benefit rule states that if a deduction is taken in a prior year and the underlying amount is recovered in a subsequent period then the.

A rule that if one receives a tax benefit from an item in a prior year because of a deduction such as for an uninsured casualty loss or a bad debt write-off and then recovers the money in a. This is done by calculating the present value of the after tax cash flows attributable to the asset where the cash flows do not reflect amortization charges in the tax. Dividing this by the marginal tax rate for regular tax purposes 28 results in 646 the approximate amount of income taxes that did not produce a tax benefit.

Ad Enter Your Tax Information.

Hra Exemption Rule House Rent Allowance Formula Hra Tax Exemption

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Annuity Taxation How Various Annuities Are Taxed

What Is The Formula To Calculate Income Tax

Tax Shield Formula How To Calculate Tax Shield With Example

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

Section 80d Deductions For Medical Health Insurance For Fy 2021 22

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

Income Tax Calculator Calculate Income Tax Online For Fy 2021 22 Fy 2022 23 Max Life Insurance

Taxable Income Formula Examples How To Calculate Taxable Income

Completion Of Age Of 60 80 For Senior Very Senior Citizen Status Benefit Under Income Tax Ca Club

How To Calculate Standard Deduction In Income Tax Act Scripbox

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

How Is Taxable Income Calculated How To Calculate Tax Liability

80gg Tax Benefit For Rent Paid

Gratuity Eligibility Rules Calculation And Income Tax Benefits Plan Your Finances

Taxable Income Formula Calculator Examples With Excel Template

How To Calculate Standard Deduction In Income Tax Act Scripbox